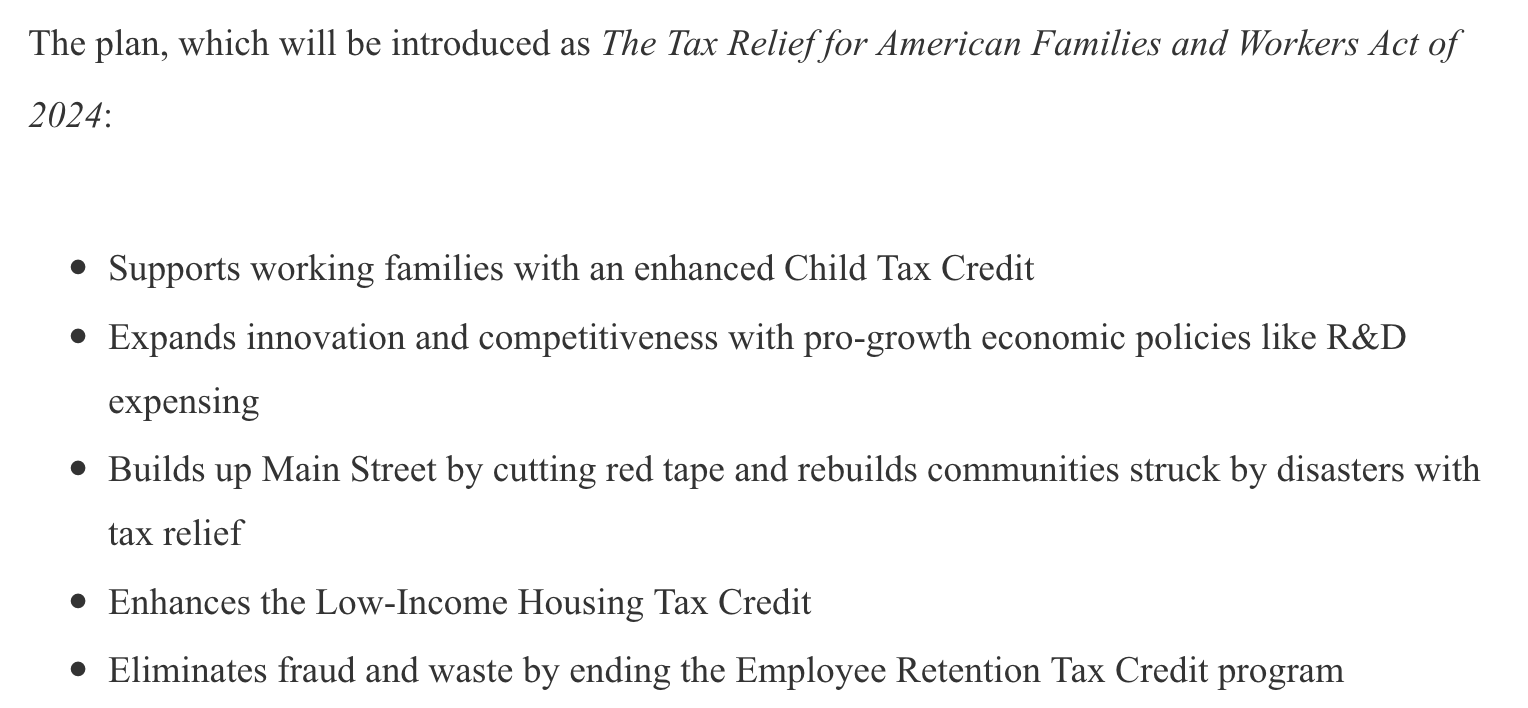

Tax Relief For American Families And Workers Act Of 2024 Income – The proposed deal would expire in 2025, teeing up a major tax battle for the next Congress after the 2024 elections. . Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how many children they have. .

Tax Relief For American Families And Workers Act Of 2024 Income

Source : twitter.com

Bipartisan Tax Framework: Low Income, Wealthy Households Benefit

Source : www.taxpolicycenter.org

What to Expect from the Tax Relief for American Families and

Source : www.mgocpa.com

Bipartisan Tax Proposal Would Benefit Lowest and Highest Income

Source : finance.yahoo.com

The Tax Relief for American Families and Workers Act of 2024

Source : www.wolterskluwer.com

How Would the Tax Relief for American Families and Workers Act

Source : www.pgpf.org

Kyle Pomerleau on X: “The bad stuff is hidden in the effective

Source : twitter.com

Tax Relief for American Families and Workers Act of 2024

Source : tax.thomsonreuters.com

T24 0003 – Major Child Tax Credit (CTC) Provisions in the The Tax

Source : www.taxpolicycenter.org

Tax Policy Center | Washington D.C. DC

Source : www.facebook.com

Tax Relief For American Families And Workers Act Of 2024 Income Tax Policy Center on X: “Tax Policy Center estimates show that the : Two tax proposals in Congress are getting attention. One would offer tax breaks for businesses and low-income families. The other would repeal the federal estate tax. . The deal announced Tuesday is the closest they’ve gotten. It wouldn’t be as impactful as the 2021 checks, which lifted close to 3 million kids out of poverty. But the expansion, which would expire in .