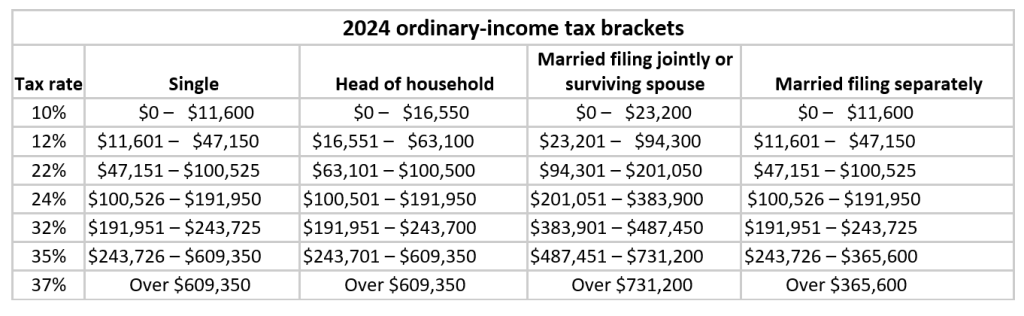

Tax Brackets 2024 – 2025 – There are seven federal income tax rates for 2023 and 2024: 10%, 12%, 22%, 24%, 32%, 35% and 37%, depending on your taxable income and filing status. . These will be in place through the 2025 fiscal year, after which time, with no Congressional action, the tax rate will increase for all except the lowest. The annual adjustment is designed to avoid .

Tax Brackets 2024 – 2025

Source : www.cnbc.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

2024 Tax Brackets and Federal Income Tax Rates | Tax Foundation

Source : taxfoundation.org

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

The 2024 cost of living adjustment numbers have been released: How

Source : www.heritagewealth.net

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

Tax Foundation on X: “The IRS released its new inflation adjusted

Source : twitter.com

IRS: Here are the new income tax brackets for 2024

Source : www.cnbc.com

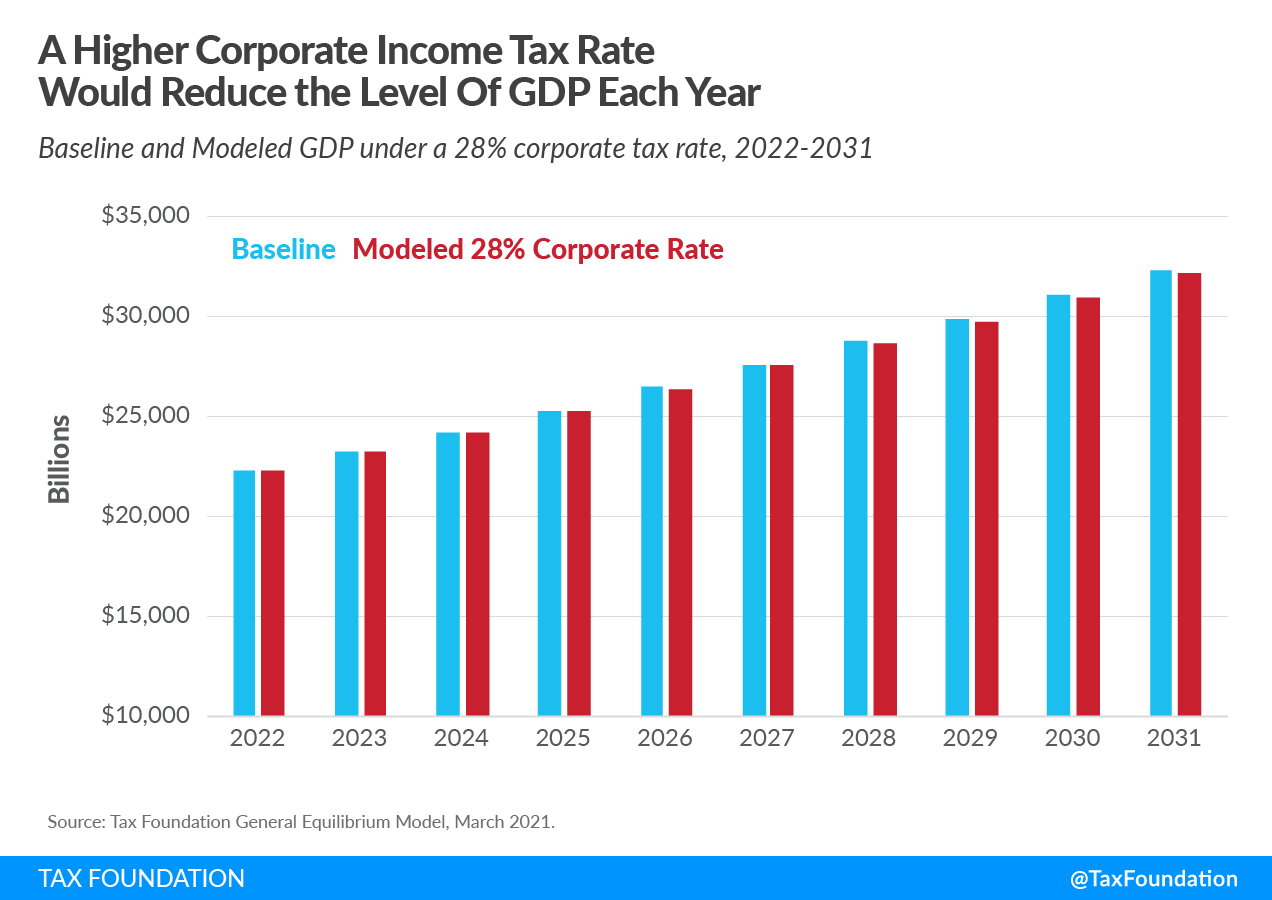

Increasing the Corporate Rate to 28% Reduces GDP by $720 Billion

Source : taxfoundation.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Tax Brackets 2024 – 2025 IRS announced new tax brackets for 2024—here’s what to know: But if you want to lower your tax bill for 2024 and beyond being in a higher tax bracket means you have more money in your pocket — which is a good thing. Alert: highest cash back card we’ve seen . The IRS reviews all income tax brackets annually, making adjustments as necessary to balance for inflation. For the 2024 tax year, tax rates range from 10% at the low end to a top rate of 37%. These .